GB Electricity Network Licensees have submitted £600m of bids to the Low Carbon Networks Fund and Network Innovation Competition since 2010. Here’s how it played out, in charts.

- These charts were made using Tableau.

- Click/tap on any chart to make it bigger.

- You can view the interactive versions of these charts on Tableau Public.

- All the data comes from documents in the public domain. Contact me via LinkedIn if you want a copy of the dataset.

Disclaimer: Observations and opinions are my own, and do not necessarily reflect those of my employer.

What’s happening this year?

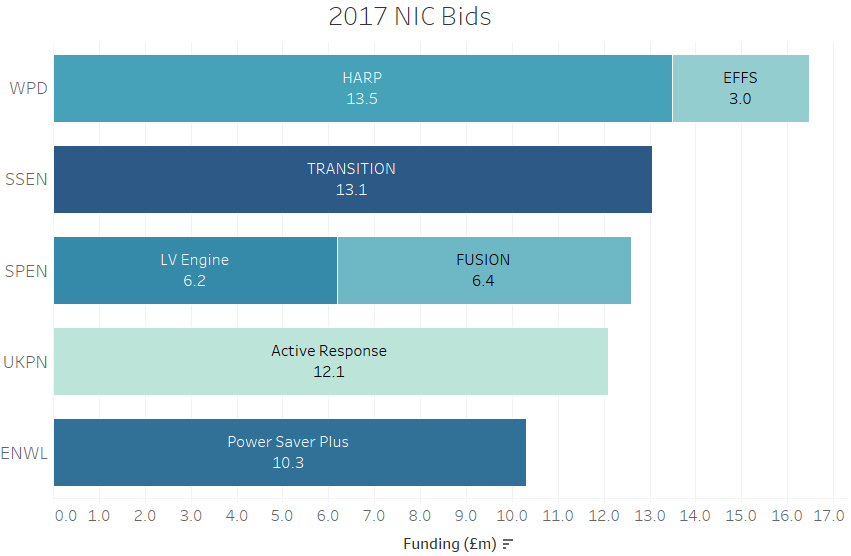

In the 2017 Network Innovation Competition, GB Electricity Network Licensees collectively bid for £64.5m worth of projects, and there is a total of £70m available.

In the 2017 Network Innovation Competition, GB Electricity Network Licensees collectively bid for £64.5m worth of projects, and there is a total of £70m available. NB these figures are taken from the Initial Screening Proposals; the amount of funding requested in the Final Submission Proposals may differ. WPD and SPEN have both bid for two projects each, and NPG and NGET are notably absent.

- These figures are taken from the Initial Screening Proposals; the amount of funding requested in the Final Submission Proposals may differ

- WPD and SPEN have both bid for two projects each

- NPG and NGET are notably absent

What happened in past years?

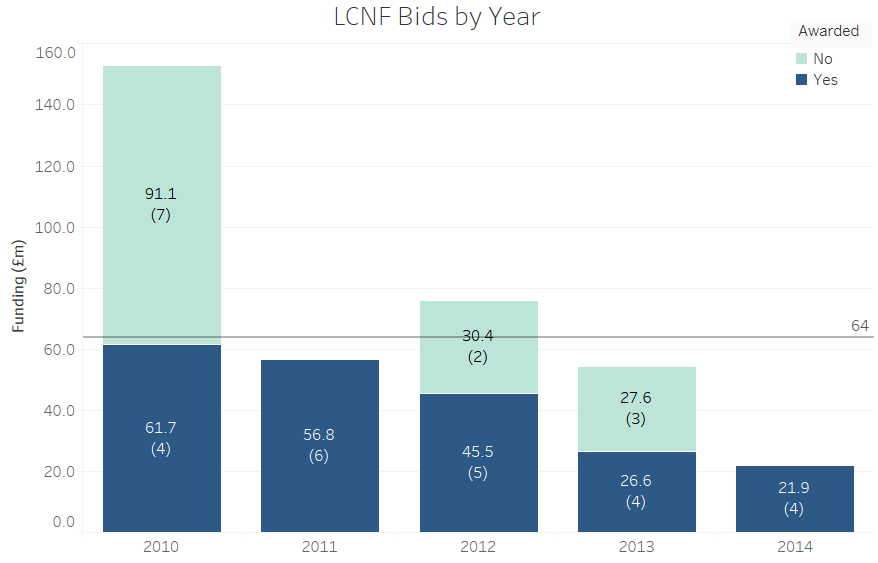

Low Carbon Networks Fund - 2010 to 2014

From 2010 to 2014, GB Electricity Network Licensees bid for 35 Low Carbon Networks Fund (LCNF) Tier 2 projects worth £362m, and Ofgem awarded funding to 23 projects worth £213m.

From 2010 to 2014, GB Electricity Network Licensees bid for 35 Low Carbon Networks Fund (LCNF) Tier 2 projects worth £362m, and Ofgem awarded funding to 23 projects worth £213m. 2010 and 2012 were the only years where the fund was oversubscribed.

2010 and 2012 were the only years where the fund was oversubscribed.

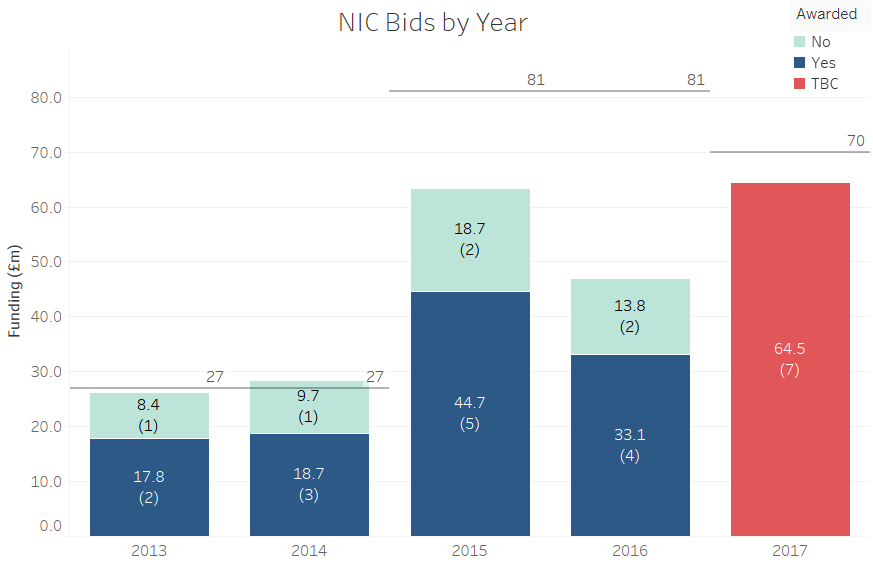

Electricity Network Innovation Competition - 2013 to present

From 2013 to 2017, GB Electricity Network Licensees bid for 27 Network Innovation Competition (NIC) projects worth £230m, and Ofgem has so far awarded funding to 14 projects worth £114m.

From 2013 to 2017, GB Electricity Network Licensees bid for 27 Network Innovation Competition (NIC) projects worth £230m, and Ofgem has so far awarded funding to 14 projects worth £114m. The competition has been undersubscribed every year except for 2014. The competition was only open to Transmission Licensees in 2013 and 2014, and the available funding was increased to £81m in 2015 to allow for the Distribution Licensees to enter the same competition. The available funding was reduced to £70m in 2017 as a result of Ofgem's consultation on innovation funding.

- The competition has been undersubscribed every year except for 2014

- The competition was only open to Transmission Licensees in 2013 and 2014

- The available funding was increased to £81m in 2015 to allow for the Distribution Licensees to enter the same competition

- The available funding was reduced to £70m in 2017 as a result of Ofgem’s consultation on innovation funding

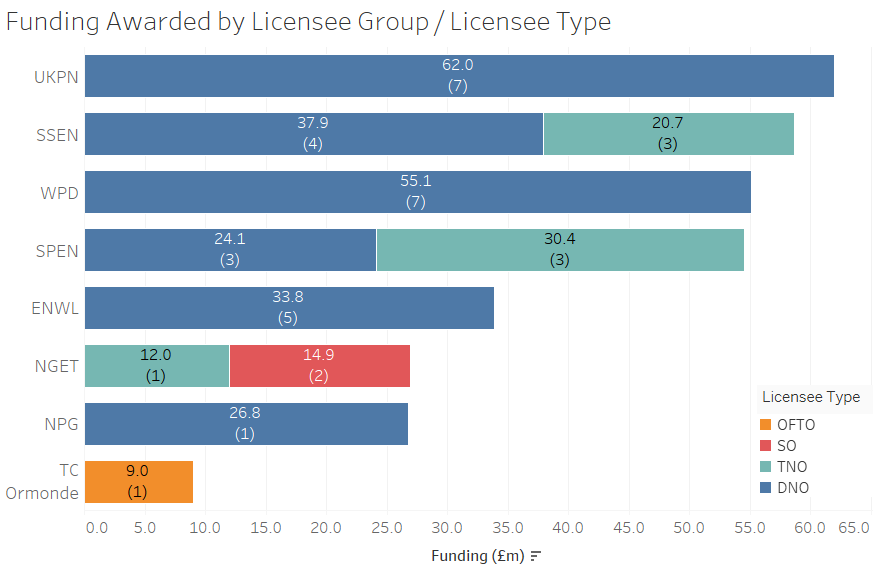

Which companies got the funding?

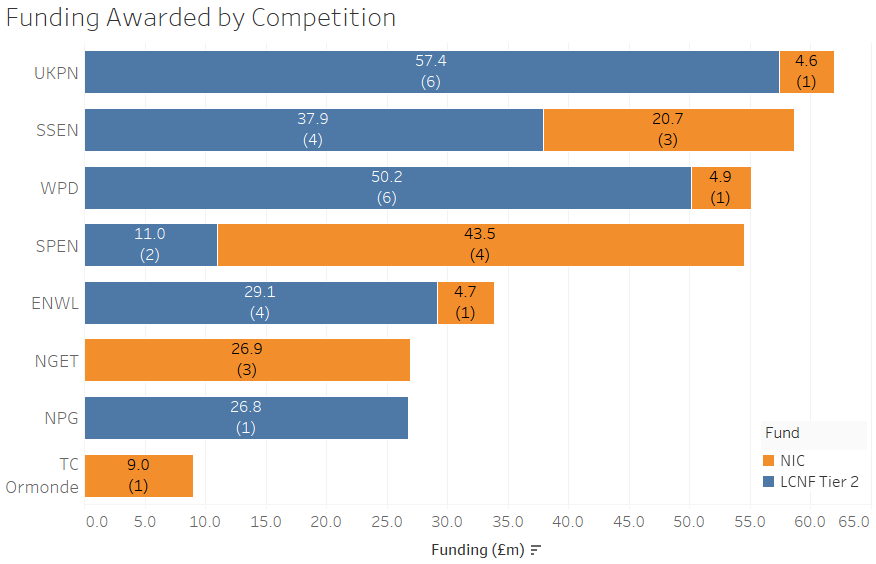

Between the LCNF Tier 2 and NIC, Ofgem has funded 37 projects worth £327m. UK Power Networks has received the most funding of any Network Licensee Group (£62m).

Between the LCNF Tier 2 and NIC, Ofgem has funded 37 projects worth £327m. UK Power Networks has received the most funding of any Network Licensee Group (£62m).

UK Power Networks has won the largest share of the LCNF Tier 2 (6 projects worth £57.4m), and Scottish Power Energy Networks has won the largest share of the NIC (4 projects worth £43.5m).

UK Power Networks has won the largest share of the LCNF Tier 2 (6 projects worth £57.4m), and Scottish Power Energy Networks has won the largest share of the NIC (4 projects worth £43.5m).

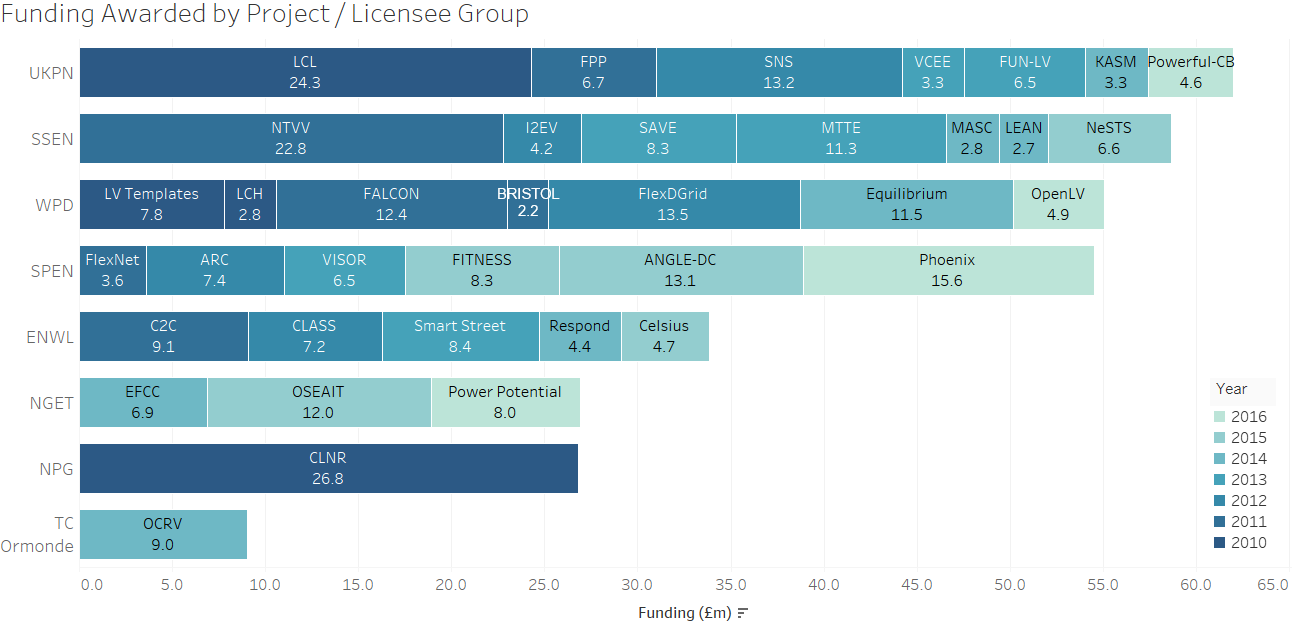

Which projects got the funding?

This is fairly self-explanatory.

Interesting points here: The overall trend has been from all-encompassing mega-projects (LCL, CLNR, NTVV) towards smaller projects with more-focused scopes. The biggest project was NPG's Customer-Led Network Revolution (CLNR) worth £26.8m. The smallest project was WPD's BRISTOL project worth £2.2m. The average project funding is £8.8m.

Interesting points here:

- The overall trend has been from all-encompassing mega-projects (LCL, CLNR, NTVV) towards smaller projects with more-focused scopes

- The biggest project was NPG’s Customer-Led Network Revolution (CLNR) worth £26.8m

- The smallest project was WPD’s BRISTOL project worth £2.2m

- The average project funding is £8.8m

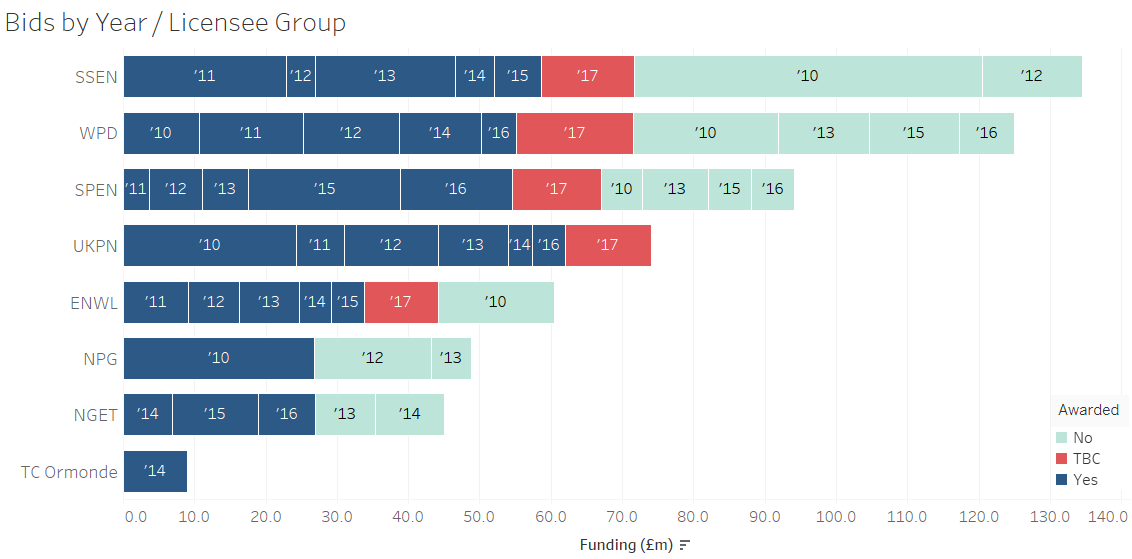

Which company has the best success rate?

UK Power Networks is (to date) the only RIIO Network Licensee Group that has won every project it has bid for (TC Ormonde is a non-RIIO Licensee). UKPN has to date won the most LCNFT2/NIC funding, but this could change depending on the outcome of the 2017 NIC.

UK Power Networks is (to date) the only RIIO Network Licensee Group that has won every project it has bid for (TC Ormonde is a non-RIIO Licensee). UKPN has to date won the most LCNFT2/NIC funding, but this could change depending on the outcome of the 2017 NIC.

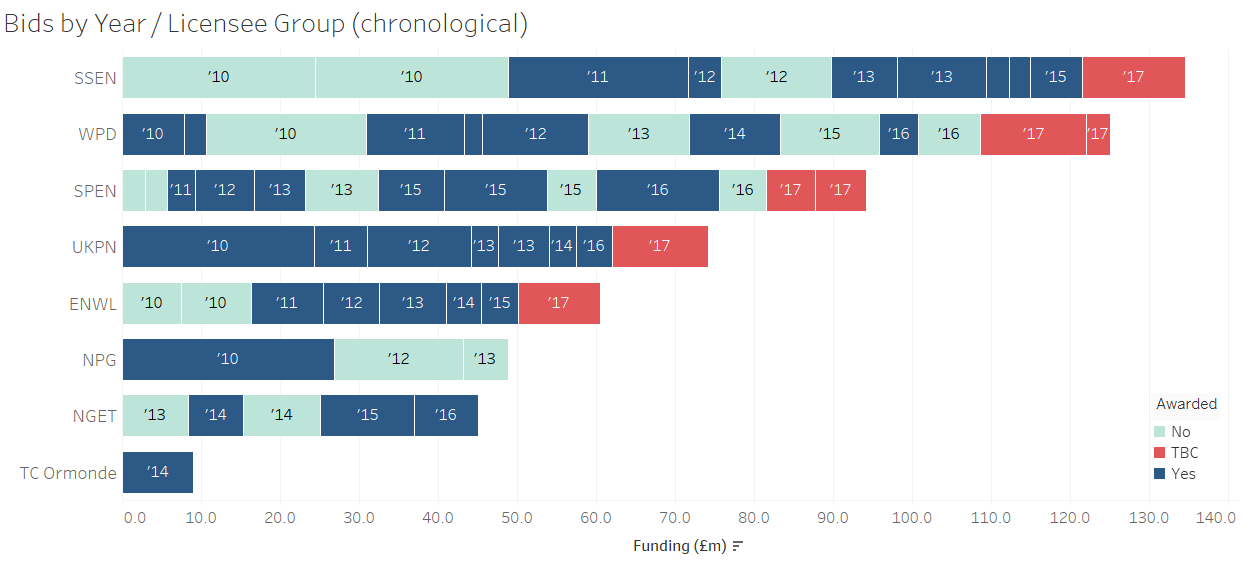

If we arrange the projects chronologically, we can see some stories emerge.

If we arrange the projects chronologically, we can see some stories emerge. NPG appears to have given up on bidding after two unsuccessful bids in 2012 and 2013. ENWL appears to have learnt from their unsuccessful bids in 2010, and won every project they have bid for since 2011. SSE, WPD, SPEN, and NGET have had mixed success. UKPN is to date the only RIIO group with a 100% success rate.

- NPG appears to have given up on bidding after two unsuccessful bids in 2012 and 2013.

- ENWL appears to have learnt from their unsuccessful bids in 2010, and won every project they have bid for since 2011.

- SSE, WPD, SPEN, and NGET have had mixed success.

- UKPN is to date the only RIIO group with a 100% success rate.

You can view the interactive versions of these charts on Tableau Public.